Therefore, just by glancing at the components of each type of cash flow, one can spot the differences between them. These activities, as discussed above, usually include transactions such as issuance or buyback of stocks, payment of cash dividends, borrowing or repayment of borrowings, etc.

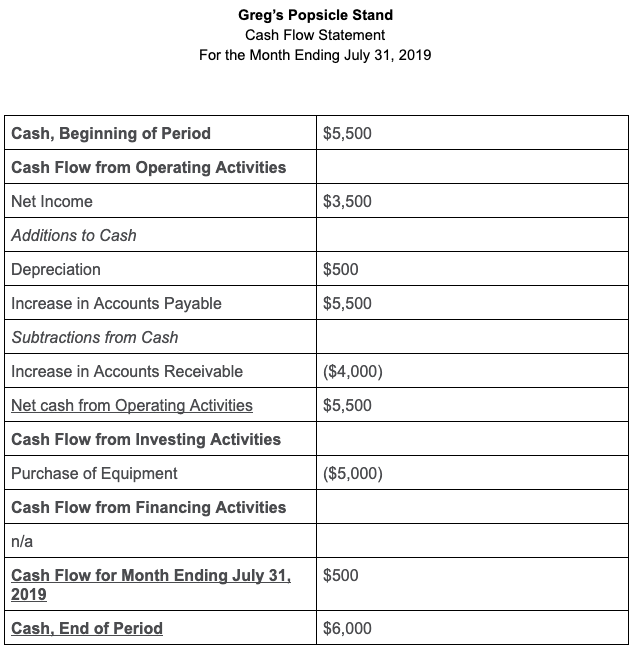

In simple terms, cash flow statements tell us how efficient a company is in converting its profits into real cash. Understanding the cash flow allows one to understand the business better and make informed investment decisions. This increase in the importance of cash flows is primarily due to the increasing use of the discounted cash flow method ( DCF) to evaluate companies and assets. However, over time, investors have begun to independently examine each of these statements, with more importance on the cash flow figures.

Investors used to look at the income statement and balance sheet for hints about the company's financial status.

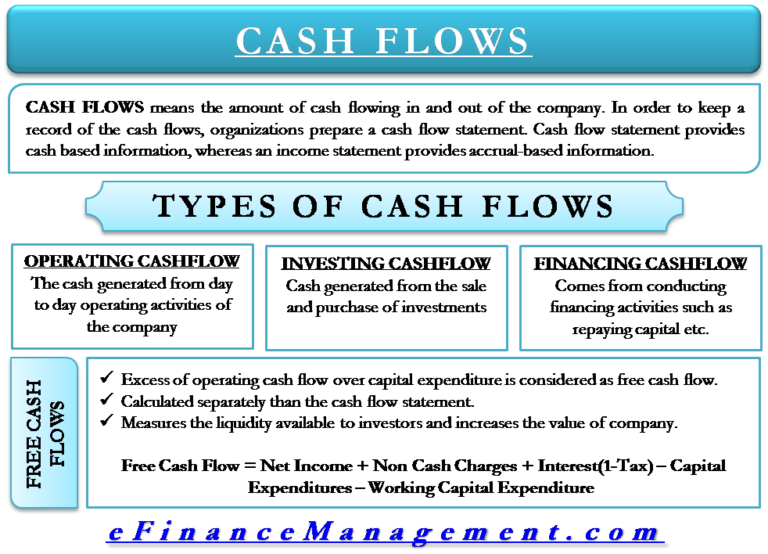

However, there are certain exceptions in the format of the statement of cash flows,įor instance, small businesses which do not use leverage or pay dividends to their shareholders do not include cash flow from financing in the cash flow statement. These can often lead to the nullification of cash generated/used in the company's core operations. This is especially true for large companies as this section can represent transactions that lead to sizable inflows/outflows of cash. In simple words, it monitors the net change in cash related to capital raising and related activities.Įxamples of financing-related activities are - borrowing or repayment of the debt, issuing additional stock or buyback of existing stock, and paying dividends to investors.Ĭash flow from financing activities is considered one of the most important sections of the statement of cash flows. What is it?Ĭash from financing activities represents the source or way a company raises capital and covers the return of the capital raised to the investors. This article will cover cash flow from financing activities, one of the three activities from which a company generates cash flows (the other two being operating and investing activities) present in a firm's cash flow statement. Knowing the amount of cash a company generates and possesses and the activities it generates it from can be extremely useful in most cases. It gives us an idea about the company's actual cash position rather than simply presenting on-paper profits like the income statement.

The cash flow statement is one of the three main statements that comprise a company's financial statements (the other two being the balance sheet and the statement of profit or loss).

0 kommentar(er)

0 kommentar(er)